Estate Planning and Wills for Seniors

Proper estate planning and having a valid will are of the utmost importance for seniors- in any situation, it is always best to be prepared.

The most important reason to make a will is so your assets can be distributed according to your specifications after your passing. When writing your will, you can choose exactly who will get what, erasing the possibility of conflicts or confusion between your family members.

Some seniors might think that they are simply “not rich enough” to have a will. However, lawyer Adam Cappelli points out that a will doesn’t only cover the distribution of your assets. It also includes logistical issues like your preference of burial or cremation, and even filing tax returns.

ADVERTISEMENT

“You need to have a legal representative named to step into your shoes and to clean up whatever remaining issues need to be [attended to],” Cappelli says.

The co-founder of Cambridge LLP, an Ontario law firm with offices across the province, Cappelli has been working in trust and estates for the last two decades and has seen the good, the bad, and the ugly when it comes to wills and estate planning.

What happens if you die without a will?

In the unfortunate circumstance that you die without a will in Ontario, Canada, it isn’t the end of the world, Cappelli says.

After taxes, the government will not take possession of any part of your estate, and your assets will still be distributed among your immediate family. Exactly what happens depends on the jurisdiction in which you live.

So for people in Ontario, Canada, Cappelli says, if you die without a will, “sleep easy because the Ontario government has written one for you. There is a legislated, formulaic distribution of your estate if you die without a will.”

If you’re married and have no children, the law states that your assets will pass to the surviving spouse.

If you’re married and have a child, your assets will be split between your child and your spouse. However, your assets are not divided equally. Your spouse is entitled to the first $350 000 of your assets.

If your estate is worth less than $350 000, everything will go to your spouse.

If it is worth more, whatever is left over will be split equally between your child and your spouse. If your child is under the age of 18, the assets they are set to receive could be liquidated (sold off) and managed by the government.

It is important to note that these rules only count if you are legally married. The same restrictions do not apply to common-law spouses.

This creates a complication for the common-law spouse that’s left behind..

“If you [were] not legally married, then you have to establish that you contributed to the deceased’s estate in some way,” Cappelli says.

Although all hope is not lost if you die without a will, this does not mean that you should not write one. If you die without a will, the taxes that have to be paid are higher, and your preferences on the division of your assets are not considered.

It is always better to be prepared.

How can you write a will?

Cappelli says it is always best to be careful and go to a lawyer for help writing your will. If you decide to write it yourself to save costs, it can be very easy to make mistakes. This can cost more money in the future through litigation of your estate.

A valid alternative to a conventional will is a holographic will. This is a will that is written entirely in your own handwriting. Nobody else can do this for you. Holographic wills are sometimes written in emergencies to express someone’s final wishes when it is impossible to do so any other way.

Don’t rely on a holographic will or a self-typed will when you have the means to do otherwise. Getting your will professionally written with the help of a lawyer may cost more money upfront. Still, it will save money and stress later on, Cappelli says.

Can a will be changed after death?

It is challenging for a will to be struck down, but it is not impossible.

Your will can be struck down if somebody can prove that you lacked the mental capacity to write the will, that you didn’t have it witnessed, that you didn’t sign it, that you didn’t understand the contents of the will, or that it was written under undue influence.

ADVERTISEMENT

The criteria for having the mental capacity to write a will are as follows: knowing what assets you own, their approximate values, who your family members are, and why you are including them or excluding them from your will.

It can be tough to prove some of these things. However, seniors must still make sure that they have correctly written their will and that it has been witnessed and signed so that it is valid and effective after their passing.

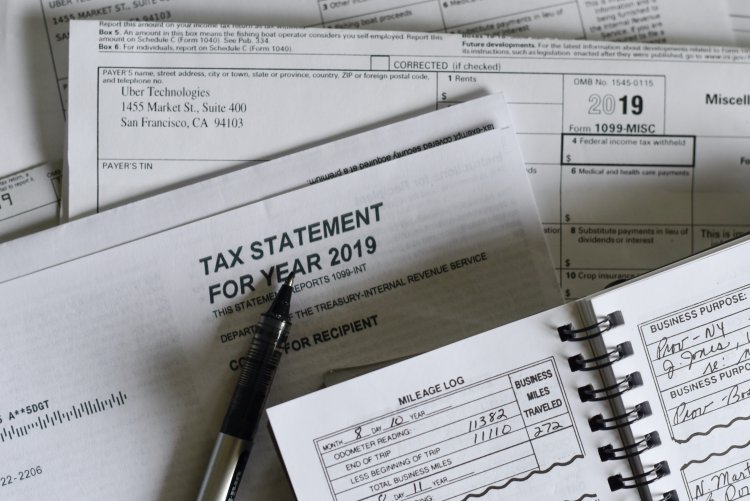

Taxes on your estate

Two taxes will affect your estate after your death. The first is the Estate Administration Tax (EAT), which is also known as a probate fee. This tax is in place so that the executor can legally administer your will.

The EAT taxes 1.5% of the value of your total assets, but there is a Small Estate Waiver for estates worth less than $50,000.

If you have a terminal diagnosis, you can begin to advance your estate before you die by putting your assets in the names of your inheritors. Doing this will save money on EAT, Cappelli says.

However, he advises that it is risky to do this if you know that your passing is not imminent.

By putting your assets in someone else’s name, you make yourself vulnerable in your lifetime, Cappelli warns. It is always better to continue controlling your wealth and avoid potential risks than to save a small amount of money after dying, he advises.

The other tax that applies to your estate after your death is the income tax. Any income earned in the last year of your life is subject to income tax, and most properties are also subject to capital gains tax.

The government of Canada considers that any capital property you own has been “sold” at its market value right before death, even if it actually hasn’t been, Cappelli says.

Half of the “capital gain” on these properties is taxable.

When should you update your will?

You should revise your will throughout your life as your circumstances change, Cappelli advises.

Any major life event, like a marriage, divorce, or even receiving a large amount of money, is a good reason to amend your will. Major life events like these can also happen to seniors later in life, so don’t be mistaken in thinking updating your will no longer matters.

However, in certain situations, you should also make sure to wait an appropriate amount of time before amending your will in case circumstances change once again.

An example is removing an heir from your will. You should wait until it is clear that the relationship in question is irreparable before moving forward to disinherit someone, Cappelli says.

Who should you name as executor?

The decision of who to name as executor of your will is an important one. Make a careful, informed decision and make sure the person you name as executor is aware of the decision and willing to fulfill the position’s duties, Cappelli says.

Choose a trustworthy and reliable person. They need to be available to execute your will. Even if somebody is the most responsible person you know, they won’t be any help if they are on the other side of the planet.

You can also pay to have a corporate trustee from a bank be your executor. This could be a good option because such an official will have experience and be reliable. Their position as executor will not cause emotional strain between your family members, Cappelli says.

How should you choose a lawyer to help write your will?

It is important to note that you truly get what you pay for when choosing a lawyer. Capelli says that fees for legal services are based on compensating for time spent. This means that the less you pay, the less time will be spent on your will.

ADVERTISEMENT

Ultimately, it isn’t worth saving a few hundred dollars for a lower quality will that may not cover all the bases, Cappelli says.

“Prioritize where you spend your money and get a proper will done,” he says.

BIO

Adam Cappelli is the co-founder of Cambridge LLP, a law firm with offices in Toronto, Burlington, and Elliot Lake. He co-founded the firm in 2010 and is the managing partner of the Estates Group of Cambridge LLP, which focuses on estate planning, estate administration, and estate litigation. Cappelli has over 25 years of experience working in trust and estates law and is certified as a Specialist in Estates and Trust Law by the Law Society of Ontario.

For more information go to: Cambridge LLP

Anna Noseworthy-Turgeon

Anna Noseworthy-Turgeon